Jun 3, 2024

Soft Launch/Pilot Program for Advance Tax Rulings in China

by Mei Zhang

Under mainland China’s tax system, tax bureaus have relatively strong discretionary power in the application of tax laws. Additionally, because the informal rulings of tax authorities are almost never disclosed to the public, and considering that judicial judgements involving tax laws are relatively few and of limited referential value, many companies doing business in China often face the predicament of not having any precedents to follow when judging whether they are entitled to tax incentives or whether they are subject to potential tax risks. In practice, this information mismatch routinely results in tax disputes between companies and PRC tax authorities.

In light of this background, in recent years, more and more tax bureaus in China have issued policies that allow taxpayers to apply for “advance tax rulings”, which help to enhance tax certainty and reduce the tax risks faced by companies in their business decision-making processes.

Definition of Advance Tax Rulings

Advance tax rulings specifically refer to services that allow companies operating in China to apply to PRC tax bureaus for official guidance on how to apply applicable tax laws and regulations to specific (typically complex) tax-related matters expected to occur in the future. As part of these procedures, the tax bureaus will provide their advice and judgements in writing, based on their interpretations of current tax laws and regulations.

Since advance tax rulings in China have so far only been implemented on a trial basis in various regions, and are currently not legally binding, taxpayers who decide to undertake such rulings are currently able to use these procedures to gauge the views/interpretations of PRC tax authorities, without necessarily being required to comply with the ultimate findings/ruling results. For the same reason, at this time, taxpayers do not have a formal means of challenging such rulings (whether in the form of administrative appeals or court litigation).

Development of Advance Tax Rulings in China

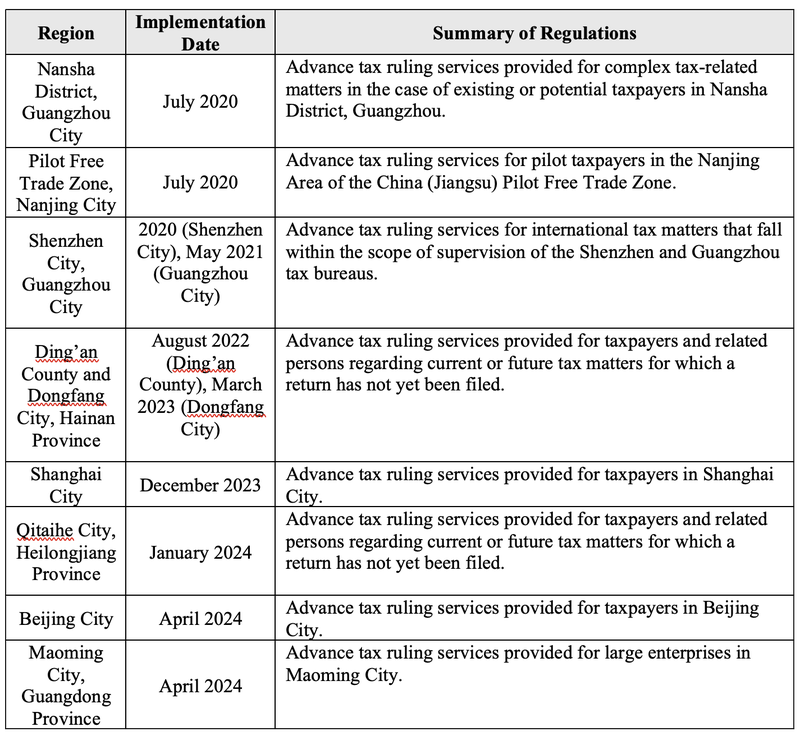

Up to now, although the State Taxation Administration of the People’s Republic of China has not yet issued any unified regulations on advance tax rulings, some regional tax bureaus have started to provide advance tax ruling services in their own jurisdictions. The evolution of these programs is summarized in the table below:

Comparison of Differences in Advance Tax Ruling Policies in China’s First-Tier Cities

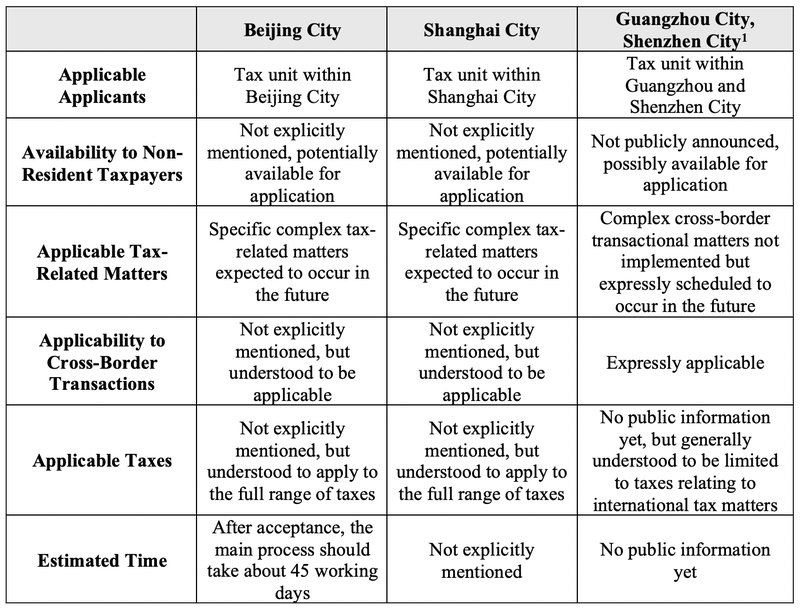

Considering the large number of companies that conduct business in China’s first-tier cities (i.e., Beijing, Shanghai, Guangzhou and Shenzhen), a summarized comparison of the key advance tax ruling policies in these cities is provided in the table below:

[1] Since the relevant implementation details in Shenzhen have not yet been formally announced to the public, the information here has been compiled based on relevant information published on the official website of the Shenzhen Tax Bureau.

DaHui Observations

Although the current advance tax ruling system in China is still subject to considerable limitations, the existing framework does provide certain safeguards for companies doing business in China, both enabling increased tax certainty when making business decisions and also reducing tax risks. In our experience, we anticipate that the advance tax ruling system in place at this time may be especially helpful under the following scenarios:

- Special tax treatment in cross-border M&A reorganizations: Determining the applicability of tax incentives applicable to a cross-border M&A transaction can be better predicted in advance if prior advice and judgement from the tax bureaus can be obtained via an advance tax ruling.

- Enjoyment of tax treaty treatment for the overseas payment of dividends, interest and royalties, and determination of beneficiary owners: Determining applicable tax benefits in advance can help avoid subsequent questioning by tax authorities resulting in tax repayments, late payment fees and fines.

- Indirect transfers of property of Chinese enterprises by non-resident enterprises: Advance tax rulings can help facilitate the determination of transaction modalities and structures to maximize applicable tax benefits and control tax risks.

- Determination of permanent establishment: Advance tax rulings can help determine whether a company’s business operations are likely to give rise to permanent establishment risks, and help companies structure their cross-border staffing arrangements.

In order to better take advantage of China’s advance tax ruling policies, it will be important for companies with operations in China to analyze and anticipate the potential positions that relevant PRC tax bureaus may take in the future, as well as their subsequent policy trends, based on the way that the current system is implemented and evolves over time. Meanwhile, it is also essential for companies to maintain active communication with PRC tax bureaus in the course of implementing any provided advance tax ruling opinions, so as to clarify any unanticipated issues and tax risks. Where necessary, we suggest that enterprises also consider seeking advice and guidance from tax professionals, who can assist in both assessing and leveraging the potential benefits companies may enjoy under these policies.

Nov 21, 2025

DaHui Recognized Among Top PRC Firms by The Legal 500 in Over Fifteen Rankings

Read Article

Oct 27, 2025

PRC Supreme Court Finalizes DaHui’s Complete Victory for Italian Company in Cross-Border Commercial Dispute

Read Article